Forex trading has gained massive popularity in recent years, and for good reason. The foreign exchange market offers endless opportunities for traders looking to profit from currency fluctuations. However, many potential traders are often deterred by high initial capital requirements. Fortunately, with the advent of online brokers, it’s now easier than ever to start trading with a low minimum deposit. In this article, we delve into the advantages of trading Forex with smaller amounts and how you can make the most out of your journey, including resources like forex trading low minimum deposit Web Global Trading.

Understanding Forex Trading

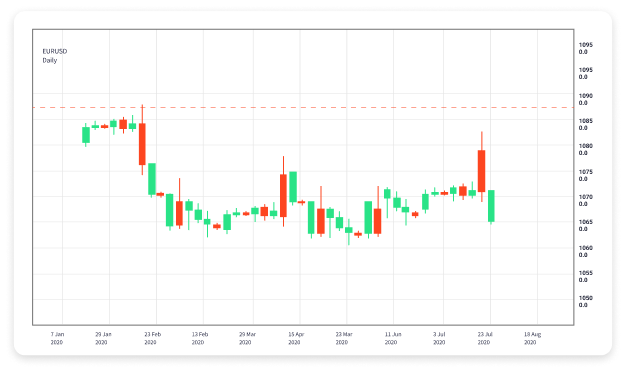

Forex, short for foreign exchange, involves trading one currency for another with the aim of making a profit. It is the world’s largest financial market, with an average daily trading volume exceeding $6 trillion. Unlike traditional stock markets, Forex operates 24 hours a day, allowing traders to engage in buying and selling at any time that suits them. The accessibility and liquidity of Forex make it an attractive option for many investors.

Low Minimum Deposit Brokers

One of the most significant barriers to entry in Forex trading has traditionally been the requirement for a hefty initial deposit. However, the landscape has changed significantly in recent years. Many brokers now offer accounts that allow traders to start with a minimal investment, sometimes as low as $50 or even less. This opens up Forex trading to a broader audience, including students and small-scale investors who may not have large sums of money to invest.

Advantages of Low Minimum Deposits

Beginning your Forex trading journey with a low minimum deposit has several advantages:

- Lower Risk: Starting with a minimal investment helps to minimize the financial risk involved. It allows new traders to experiment with various strategies and trading styles without risking significant amounts of money.

- Accessibility: Low deposit requirements make Forex trading accessible to a larger demographic, democratizing trading for individuals who may not otherwise have the means to participate.

- Flexibility: You can choose to increase your investment as you gain confidence and experience in the market.

Choosing the Right Broker

When opting for a broker, it’s essential to conduct thorough research. Here are some critical factors to consider:

- Regulation: Ensure the broker is regulated by a reputable authority. This adds a layer of security to your trading activities, safeguarding your funds.

- Trading Platform: Look for a user-friendly trading platform that offers the tools and features needed for effective trading.

- Spreads and Fees: Low spreads and transparent fee structures can significantly impact your profitability in the long run.

- Customer Service: Responsive customer support is essential, especially for new traders who might need assistance.

Developing a Trading Strategy

No matter your account size, having a solid trading plan is crucial for success in Forex. Here are some strategies that work well, even for traders with lower capital:

1. Scalping

Scalping involves making quick trades aimed at getting small profits from minor price changes. It often requires a high level of focus and quick decision-making skills.

2. Swing Trading

This strategy involves holding positions for several days or even weeks to capitalize on expected upward or downward market shifts. It is less time-consuming compared to scalping and can be suitable for those with minimum deposits.

3. Use of Leverage

Many brokers allow you to use leverage, which enables you to control larger positions with a smaller amount of capital. While leverage can amplify your profits, it also increases the potential for losses, so understanding its risks is vital.

Risk Management Techniques

Managing risk is crucial when trading, especially with smaller accounts where losses can quickly deplete your funds. Here are some risk management strategies:

- Set Stop-Loss Orders: These orders automatically close your position at a predetermined price to help you manage potential losses.

- Use Position Sizing: Determine the amount of capital you’re willing to risk on each trade. A common rule is to risk no more than 1% of your total capital on a single trade.

- Diversify: Avoid putting all your capital into one trade or currency pair. Diversifying your investments can help manage risk better.

Education and Resource Utilization

Knowledge is power in Forex trading. As a new trader with a low minimum deposit, consider investing time in educational resources. Many brokers offer free webinars, tutorials, and demo accounts, allowing you to practice without financial risk. Additionally, joining trading communities and forums can provide insights and support from experienced traders.

Conclusion

Forex trading with a low minimum deposit is not only feasible but also offers numerous opportunities for traders to learn and grow. With the right broker, strategy, and risk management techniques, even those with minimal investment can navigate this dynamic market. Whether you are a novice looking to dip your toes into trading or an experienced trader exploring new avenues, starting with a low deposit can be a strategic choice in your financial journey.

To embark on your trading adventure and to access a range of tools and resources, consider exploring platforms like Web Global Trading that cater specifically to traders with lower capital. Remember, the key to success in Forex is continuous learning, practice, and strategic planning.